Joinn White Paper

Bryan Benson - Beau Williams

Joinn Labs - Version 2.0

Joinn revolutionizes access to tokenized real-world assets through a sophisticated mobile and web based application built for mass adoption. Our platform is not merely another entrant in the blockchain space; it represents a paradigm shift in how individuals interact with and invest in tokenized assets. By leveraging an interoperable aggregation infrastructure and advanced blockchain technology hidden in the back end, Joinn ensures a seamless and secure user experience, making the complexities of Web3 as approachable and familiar as Web2 applications.

Executive Summary

Joinn is revolutionizing the tokenized real-world asset (RWA) market with a groundbreaking platform that democratizes access to sophisticated financial instruments. By leveraging advanced blockchain technology, Joinn transforms how individuals and institutions interact with tokenized assets, offering a seamless bridge between traditional finance and the decentralized future.

The global tokenized asset market is poised for explosive growth, projected to reach $10 trillion by 2030 from its current $300 billion valuation. This represents a staggering 33x growth potential in just six years. Joinn is strategically positioned to capture a significant share of this burgeoning market by addressing key challenges that have hindered widespread adoption, including high entry barriers, operational complexities, and poor user experiences.

At the heart of Joinn's competitive advantage is its innovative infrastructure layer that supports 24/7 trading, near-instant settlements, the transfer of value between products using an innovative “Smart Router” and unparalleled liquidity. This interoperable aggregation infrastructure, including the Joinn Stock Token Vault and Off-chain Broker work in tandem to provide a robust liquidity solution, enabling fractional ownership of high-value assets and facilitating seamless trades. This unique approach sets Joinn apart by offering institutional-grade liquidity to retail investors, a feature unmatched in the current market.

Joinn's platform is built on a foundation of cutting-edge features, including Smart Accounts for self-custodial ownership, multi-chain support for enhanced flexibility, Smart Routing for the seamless transfer of value between Real World Asset Earn Accounts, and an Aggregated Distribution Layer for best-in-class trade execution. The integration of AI-powered insights and a user-friendly interface that masks underlying complexities ensures that Joinn caters to both novice and experienced investors alike.

Led by a team of industry veterans, Joinn combines deep expertise in fintech, blockchain technology, and regulatory compliance. Co-founders Bryan Benson (CEO), Beau Williams (CTO) and Mariangel Garcia (CMO), bring extensive experience in building innovative financial solutions, supported by a network of strategic team members and advisors from leading financial institutions and technology companies.

The Joinn Token (JOINN) underpins the ecosystem, with a total supply of 420,000,000 tokens strategically allocated to align the interests of all stakeholders. This tokenomics model is designed to fuel platform growth, incentivize user adoption, and create long-term utility for token holders.

We invite investors, partners, and users to join us in this transformative journey. For investors, Joinn offers early access to a high-growth market with significant upside potential. Partners can leverage our robust infrastructure to expand their offerings in the tokenized asset space. Users gain unprecedented access to a world of investment opportunities previously reserved for institutional players.

Joinn is not just a platform; it's a gateway to the future of finance. By democratizing access to tokenized real-world assets, we're unlocking new possibilities for wealth creation and financial inclusion. Join us in reshaping the financial landscape and be part of the next big revolution in global finance.

1. The Joinn Solution

Joinn stands at the forefront of financial innovation, offering a groundbreaking platform that democratizes access to tokenized real-world assets combined with a “web2 like” user experience. At its core, Joinn leverages cutting-edge blockchain technology to create a seamless, secure, and user-friendly investment experience. The platform's key features work in concert to address the primary challenges in the tokenized asset space, from accessibility and liquidity to security and regulatory compliance.

Value Proposition and Key Features

Stock Token Vault and Off-chain Broker: Powering 24/7 Liquidity

The Joinn Stock Token Vault and Off-chain Broker form a revolutionary infrastructure for continuous RWA trading. The Vault pools tokens to bootstrap liquidity, while the automated Off-chain Broker facilitates fair trading using on-chain oracle pricing. This symbiotic system abstracts complex interfaces, provides near instant liquidity, and crucially, enables 24/7 trading of real-world assets — a significant market differentiator. Unlike traditional markets bound by exchange hours, Joinn's infrastructure allows users to trade tokenized real-world assets round the clock, offering unprecedented accessibility and liquidity in the RWA space.

Smart Accounts: Redefining User Control and Onboarding

Central to Joinn's offering are its Smart Accounts, which represent a paradigm shift in how users interact with blockchain-based financial services. These accounts provide self-custodial ownership, putting users in full control of their assets while simultaneously offering frictionless onboarding through familiar authentication methods such as email, phone, social media accounts, biometrics, and passkeys. By leveraging account abstraction techniques, Joinn enhances both security and usability, setting a new standard for user experience in the blockchain space.

Smart Router Technology

Joinn has developed Smart Router technology that enables users to simply “Transfer” value from Real World Asset Earn Account to another in one simple transaction. The Joinn Smart Router abstracts away the need for the user to perform multiple steps and automates the liquidation, withdraw and deposit of value from one product to another in one simple step.

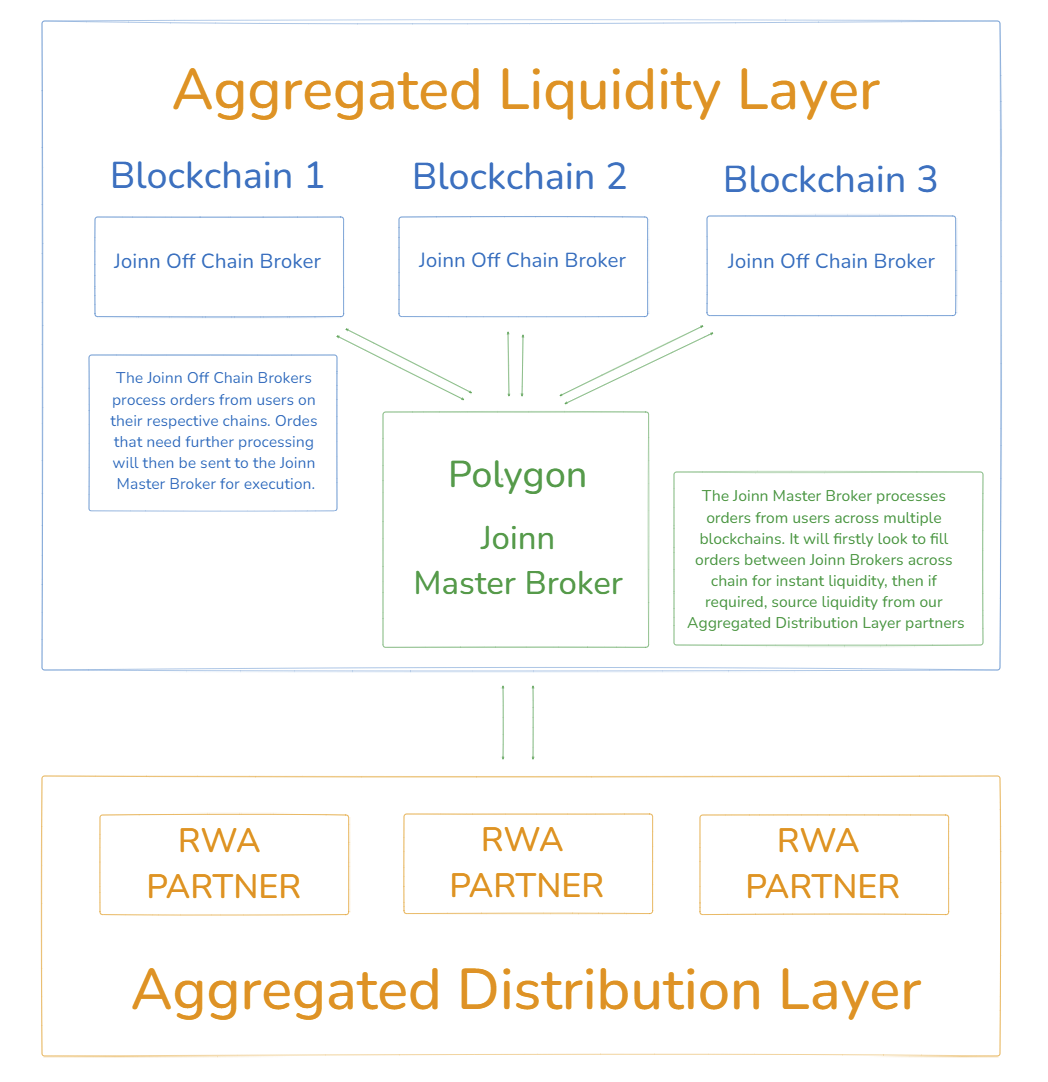

Aggregated Liquidity Solution & Multi-Chain Support: Enhancing Liquidity & Scalability

Liquidity, a critical factor in any financial platform, is addressed through Joinn's multi-chain approach and its proposed Aggregated Liquidity Layer. This solution not only allows Joinn to adapt to the ever evolving landscape of blockchain technology and the liquidity movements within it, but with the proposed Aggregated Liquidity Layer, Joinn anticipates being able to share liquidity across blockchains. This will lead to the increased ability to fill orders 24/7 reducing the need to interact with Aggregated Distribution Layer which in turn reduces costs and improves user experience by increasing on-chain liquidity.

The below diagram shows a simplified example of how the proposed Aggregated Liquidity Layer could work. There are a number of ways to solve for this that are being investigated ranging from the integration of Polygons new AggLayer to the use of Zero Knowledge Proofs.

Aggregated Distribution Layer: Enhancing Asset Distribution and Variety

Also addressing liquidity is the the Aggregated Distribution Layer which sources liquidity from multiple Real World Asset partners and expands product offerings within the tokenized asset space. This layer serves as an interoperable aggregation infrastructure, allowing seamless integration of various asset sources. Combined with Joinns sophisticated Smart Router, it allows users to move seamlessly from one Real World Asset to another in one simple transaction.

Near Instant 24/7 Liquidity: Just-In-Time (JIT) Liquidity 24/7

The JIT Liquidity feature provides near instant and composable liquidity from various sources, enabling users to execute transactions near instantly. Via a combination of how the Joinn Stock Token Vaults are structured and how the proposed Aggregated Liquidity Layer works, Joinn is able to provide near instant liquidity up to the value of USDC reserves held in each Stock Token Vault at any point in time while also monitoring for near instant liquidity within the Joinn Master Broker that processes liquidity from cross-chain Joinn users.

Tokenization Process: Bridging Real-World Assets and Digital Tokens

The tokenization process itself is a key component of Joinn's offering. By facilitating the conversion of real-world assets into digital tokens on the blockchain, Joinn opens up new investment opportunities to both retail and institutional investors. The platform employs a rigorous due diligence process for asset selection and compliance assurance, ensuring that only high-quality, regulatory-compliant assets are tokenized. This process enables fractional ownership, dramatically increasing accessibility to high-value assets that were previously out of reach for many investors.

Regulatory Compliance: Setting the Standard for Legal and Ethical Operations

In the complex regulatory landscape of digital assets, Joinn prides itself on its robust compliance framework. Built upon a comprehensive regulatory foundation, the platform ensures adherence to financial regulations and standards in the jurisdictions it offers its services in. This includes the implementation of stringent security protocols, privacy guidelines, Know Your Customer (KYC), and Anti-Money Laundering (AML) measures, providing users and regulators alike with the assurance that all activities on the platform meet the highest standards of legal and ethical compliance.

Advanced Security Measures: Protecting Users and Assets

Security is paramount in the digital asset space, and Joinn spares no effort in this regard. The platform employs advanced security measures, including comprehensive smart contract audits, sophisticated cyber defense mechanisms, and secure storage solutions for physical assets backing the tokens. Real-time transaction monitoring further enhances security and transparency, giving users peace of mind as they navigate the world of tokenized assets.

User-Friendly Interface: Simplifying Complexity

While the underlying technology is complex, Joinn's user interface is designed with simplicity in mind. The meticulously crafted user interface provides an experience akin to popular Web2 apps like Uber and Airbnb, effectively masking the underlying blockchain complexities. Available as a web-based application and soon a mobile application, Joinn ensures accessibility across different devices and platforms, meeting users wherever they are.

Gasless and Sign-less Transactions: Streamlining User Experience

Joinn further enhances user experience through its implementation of gasless and sign-less transactions. By leveraging Sponsored Gas technology for gasless transaction and Session Tokens for sign-less transactions, the platform eliminates friction in asset transfers and excessive transaction confirmation screens. These features significantly improve the overall user experience, simplifying interactions with the blockchain and making the platform more accessible and user friendly to those new to the space.

Seamless Onboarding: Bridging Web2 and Web3

Joinn's commitment to accessibility is further evident in its seamless onboarding process. By integrating non-custodial Web2 login options with Web3 technology, the platform will simplify the entry process for users new to blockchain and digital assets. This approach significantly reduces barriers to entry while maintaining high security standards, making Joinn an ideal platform for both seasoned crypto enthusiasts and those taking their first steps into the world of digital assets.

Connected Mastercard: Bringing Digital Assets to Everyday Life

The platform's features extend beyond the digital realm with the Joinn Connected Debit Mastercard. This innovative offering allows for instant spending of USDC at any point of sale accepting Mastercard, effectively bridging the gap between digital assets and real-world spending. It provides users with unparalleled flexibility in managing their digital assets, making the benefits of blockchain technology tangible in everyday life.

B2C Solutions: Catering to Diverse Market Needs

Recognizing the diverse needs of the market, Joinn offers both B2C solutions. The platform serves individual investors with user-friendly interfaces and accessible investment options. This scalable infrastructure supports various use cases, making Joinn a versatile player in the tokenized asset space.

AI-Powered Features: Insights and Assistance

Joinn further distinguishes itself with its plans to implement AI-powered features. Joinn Insights will deliver personalized, actionable investment insights by analyzing data in real-time, empowering investors with the knowledge needed to make informed decisions and optimize their portfolios. The Joinn Assistant takes user interaction to the next level, supporting intent-based commands for natural language interactions. This AI-driven system transforms user inputs into executable commands on the backend, simplifying complex financial operations and making them as straightforward as a conversation.

Messaging App Integration: Bringing Asset Management to Daily Communications

Finally, recognizing the importance of accessibility and integration with everyday tools, Joinn plans to offer mini versions of its platform integrated into popular messaging apps like Telegram and WhatsApp. This feature will allow users to access key functionalities directly within their favorite chat interfaces, bringing tokenized asset management seamlessly into their daily digital lives.

2. Market Overview

Current Market Landscape

The landscape of tokenized real-world assets is evolving at an unprecedented pace, driven by blockchain’s transformative potential. Despite the rapid advancements, the market is plagued by significant barriers, including high entry costs, security vulnerabilities, and the intricate integration required with existing financial infrastructures. The true potential of tokenization lies in its ability to democratize access to previously inaccessible assets, enhancing liquidity and providing continuous market access.

Current Market Size

The market for tokenized real-world assets (RWAs) is rapidly evolving, with various sources providing different estimates on the current and future market size. As of 2023, the market for tokenized assets was valued at approximately $300 billion. This includes a range of assets such as real estate, financial instruments, and commodities (McKinsey & Company) (Roland Berger).

Growth Projections

Several forecasts predict substantial growth in the tokenized RWA market over the next decade. Key projections include:

· $3.5 to $10 Trillion by 2030: According to digital asset manager http://21.co , the market for tokenized assets could reach up to $10 trillion in a "bull case" scenario and $3.5 trillion in a "bear case" scenario by 2030 (CoinDesk)..

· $5 to $16 Trillion by 2030: Boston Consulting Group estimates that tokenized security assets could represent approximately 10% of the global GDP by 2030, translating to a market size of $5 to $16 trillion (Finextra Research).

· $10 Trillion by 2030: Roland Berger's analysis also supports the view that the tokenized asset market could exceed $10 trillion by 2030, driven by widespread adoption across various industries (Roland Berger).

Key Factors Driving Growth

Regulatory Support: Governments and regulators in regions such as Asia, Europe, and North America are increasingly reforming regulations to better accommodate and support the tokenization of real-world assets. This regulatory clarity is crucial for the market's growth (Finextra Research).

Technological Advancements: The use of blockchain technology for tokenization provides significant benefits, including 24/7 operations, reduced transaction costs, and enhanced liquidity. Smart contracts facilitate automated and secure transactions, further driving adoption (CoinDesk) (Finextra Research).

Institutional Adoption: Major financial institutions and corporations are actively exploring and implementing tokenization. Notable examples include the issuance of tokenized bonds by Siemens and the City of Lugano, as well as blockchain-based repurchase agreements (repos) by Goldman Sachs and J.P. Morgan (McKinsey & Company).

Potential Benefits

Increased Liquidity: Tokenization allows for fractional ownership, making it easier to buy and sell small portions of high-value assets, thereby increasing market liquidity.

Operational Efficiency: Automation through smart contracts reduces the need for intermediaries, lowering transaction costs and settlement times.

Enhanced Transparency and Security: Blockchain technology ensures transparent and immutable records of ownership and transactions, reducing the risk of fraud and improving trust.

Accessibility: Tokenized assets democratize access to investment opportunities, enabling a broader range of investors to participate in markets that were previously inaccessible.

Challenges

Regulatory Uncertainty: Navigating the complex and evolving regulatory landscape remains a significant challenge for the widespread adoption of tokenized RWAs.

Technological Integration: Ensuring interoperability between different blockchain networks and integrating blockchain technology with existing systems requires ongoing technological advancements.

Market Acceptance: Achieving widespread acceptance and trust among investors and institutions is crucial. Education and awareness initiatives are important to address skepticism and build confidence.

Market Challenges

· High Barriers to Entry: Traditional financial markets are exclusionary, necessitating substantial capital and expertise, thus sidelining average investors.

· Operational Complexities: Many people find it difficult and time consuming to participate in current DeFi or RWA investing technologies and platforms.

· Security Concerns: The digital asset space is rife with security risks, requiring robust solutions to safeguard transactions and user data.

· Regulatory Compliance: The fragmented and evolving regulatory landscape poses significant hurdles, demanding a proactive and adaptive compliance strategy.

3. Joinn's Unique Selling Proposition

Revolutionary Infrastructure for 24/7 RWA Trading

Joinn stands out in the tokenized real-world asset (RWA) market with its groundbreaking infrastructure that enables continuous 24/7 trading — a feature unmatched in traditional markets. At the heart of this innovation is an interoperable aggregation infrastructure, including the Joinn Stock Token Vault and Off-chain Broker, working in tandem to provide:

· Unparalleled Liquidity: Bootstrapping liquidity by pooling tokens, ensuring instant access for users.

· Fair and Efficient Trading: Utilizing on-chain oracle pricing for transparent and equitable transactions.

· Seamless User Experience: Abstracting away the need for complex, confusing and time consuming blockchain interactions.

Multi-Chain Ecosystem

Joinn's multi-chain support ensures:

· Scalability: Seamless integration with various blockchain networks.

· Flexibility: Adaptability to evolving blockchain landscapes and liquidity movements.

User-Centric Design

Joinn bridges the gap between Web2 and Web3 with:

· Intuitive Interface: Simplifying complex blockchain interactions for all user levels.

· Smart Accounts: Leveraging account abstraction for enhanced security and usability.

· Smart Router: Simplifying the transfer of value between products.

· Diverse Authentication: Supporting email, social accounts, and Web3 wallet logins.

· AI-Driven Interactions: Personalized insights and natural language processing.

Democratized Access

Joinn opens up the world of RWA investing to a broader audience:

· No Minimum Deposits or Withdrawals: Lowering barriers to entry for investors.

· Aggregation: Providing the aggregation of a variety of onchain RWA’s into one location.

· Fractional Ownership: Enabling investment in high-value assets with minimal capital.

Rapid Settlement and Security

· Near-Instant Settlements: Ensuring quick and reliable transactions.

· Advanced Security Measures: Implementing rigorous smart contract audits and cyber defense mechanisms.

· Regulatory Compliance: Adhering to financial regulations and standards.

Unique Tokenomics Model

The Joinn Token (JOINN) underpins the ecosystem, designed to:

· Align Stakeholder Interests: Strategic token allocation for long-term utility benefits.

· Fuel Platform Growth: Incentivizing user adoption and ecosystem development.

Joinn's unique combination of 24/7 RWA trading capability, multi-chain support, user-centric design, and robust security measures positions it as a frontrunner in the tokenized asset space. By offering institutional-grade tools with retail-level accessibility, Joinn is not just participating in the future of finance — it's actively shaping it.

Let’s get a bit technical now…

4. Tokenization Process

How does Joinn Achieve Tokenization?

Joinn is able to offer regulatory compliant tokenized securities by partnering with our selected token issuers such as Swarm. Tokenized securities of any form (eg ETFs) are referred to herein as “Stock Tokens”.

Joinn's Innovative DeFi Solution

Joinn revolutionizes the trading of Stock Tokens by enhancing the traditional on-chain order book system. While our partners like Swarm offer access through dOTC(decentralized OTC), Joinn takes user experience to the next level. We've developed a cutting-edge infrastructure that simplifies trading and boosts liquidity. This advanced system consists of two key components:

The "Joinn Stock Token Vault"

The "Joinn Off-chain Broker"

Together, these create a seamless, user-friendly interface that sets a new standard for trading tokenized assets. Our solution not only meets but exceeds the high expectations for both user experience and liquidity in the DeFi space.

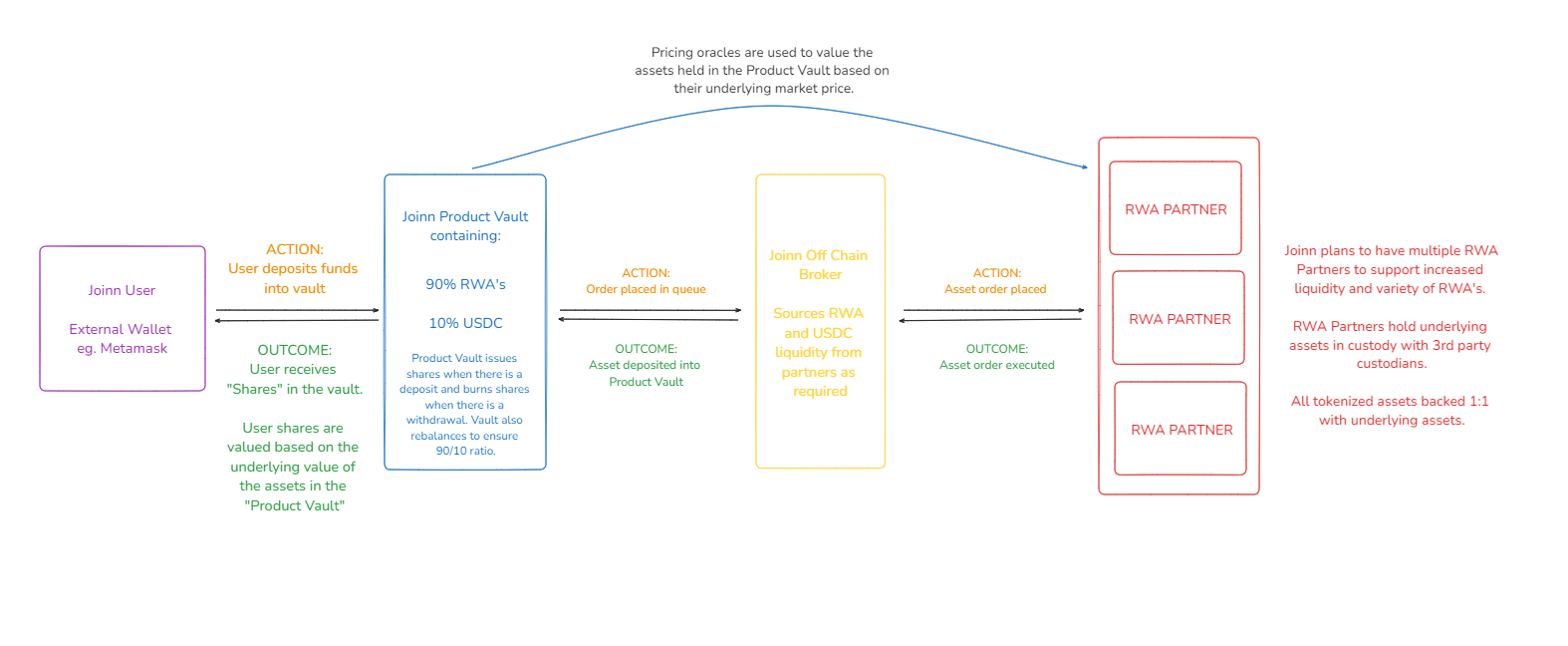

5. How It Works

The Joinn Stock Token Vault

· Acts like a pool of tokenized assets (90% RWAs) and stable coins (10% USDC).

· Users deposit funds and receive "shares" of the vault.

· These shares represent ownership of the diverse assets in the vault.

· Provides instant liquidity up to the value of USDC in the vault.

The Joinn Off-chain Broker

· An automated system that manages larger trades.

· Connects the Vault to external RWA partners when needed.

· Ensures fair pricing using reliable market data (price oracles).

The Process

Users interact only with the user-friendly Joinn interface.

Small trades are handled instantly within the Vault.

For larger trades, the Off-chain Broker automatically:

o Places orders with RWA partners.

o Adjusts the Vault's holdings accordingly.

Key Benefits for Users and Investors

Simplicity: Users don't need to understand complex trading mechanisms.

Instant Liquidity: Most trades can be executed immediately.

Fair Pricing: All trades use up-to-date market prices.

Diverse Asset Exposure: Users can gain exposure to a variety of RWAs through a single investment.

Scalability: The system can handle both small and large trades efficiently.

Security: User assets are always held in the secure Vault, not by the Broker.

Why This Matters

This innovative system allows Joinn to offer 24/7 trading of real-world assets with high liquidity and a user-friendly experience. It bridges the gap between traditional finance and the world of tokenized assets, making sophisticated investments accessible to a broader range of users.

How Assets Are Tokenized

Joinn’s due diligence on the tokenization process is both rigorous and transparent:

· Asset Selection: We carefully select assets with high market demand and regulatory viability.

· Compliance Assurance: Ensuring adherence to relevant legal and regulatory standards is paramount.

· Secure Storage: Our chosen partners ensure physical assets are stored in top-tier vaults or accredited custodians, providing robust backing for the onchain issued tokens.

· Token Issuance: Digital tokens are minted on-chain 1:1 to represent asset ownership, ready for trade and investment.

· Blockchain Integration: Siloed tokens and application specific blockchains are seamlessly integrated into our multi-chain infrastructure, enabling efficient and liquid trading.

Benefits of Tokenization

· Increased Liquidity: Our tokenized assets are tradeable around the clock, enhancing liquidity compared to traditional markets.

· Global Access: Investors in most countries can participate without geographical constraints.

· Fractional Ownership: By fractionalizing high-value assets, we lower entry barriers, enabling more diverse investment portfolios.

6. Security and Compliance

Security Measures

At Joinn, security is paramount. Our platform employs comprehensive and proactive security measures to ensure the utmost protection of our users' investments:

· Rigorous Smart Contract Audits: Regular and thorough audits of all smart contracts to identify and mitigate potential vulnerabilities.

· Advanced Cybersecurity Protocols: Implementation of state-of-the-art cybersecurity measures adhering to the ISO/IEC 27001 information security management standard.

· Secure Storage Solutions: Utilization of cutting-edge secure storage solutions for physical assets backing our tokens.

· Real-time Monitoring: Continuous surveillance of our systems to detect and respond to potential threats instantly.

· KYC/AML: Only known users can interact with the Vaults.

By prioritizing security at every level, we ensure that our platform remains resilient against evolving cyber threats, providing our users with a safe and trustworthy environment for their digital asset investments.

Regulatory Compliance

Navigating the complex regulatory landscape is crucial for long-term success in the tokenized asset space. Joinn takes proactive measures to ensure compliance with all relevant regulations:

· Comprehensive Compliance Manual: Development of a robust compliance manual that adheres to the highest industry standards, created in collaboration with our in-house compliance officer and external legal experts.

· Automated KYC/KYB Systems: Implementation of sophisticated, automated Know Your Customer (KYC) and Know Your Business (KYB) systems in partnership with Fractal ID, ensuring thorough vetting of all platform users.

· Blockchain Analysis: Collaboration with the likes of Elliptic and Chainalysis, trusted blockchain analytics firms, to monitor transactions and ensure compliance with anti-money laundering (AML) regulations.

· Regulatory Partnerships: Close working relationships with legal experts and regulatory bodies to stay ahead of regulatory changes and ensure ongoing compliance.

· Regular Audits and Updates: Commitment to regular compliance audits and timely updates to our processes in response to evolving regulatory requirements.

This unwavering commitment to compliance not only builds trust with our users but also positions Joinn as a leader in the digital asset industry. By setting the standard for regulatory adherence, we provide a secure and compliant platform that institutional and retail investors can trust with confidence.

7. Team

Key Personnel

· Bryan Benson: Co-founder and CEO, with extensive experience in fintech and blockchain technology.

· Beau Williams: Co-founder and CTO, responsible for leading product and technical development of the platform.

· Mariangel Garcia: Chief Marketing Officer, overseeing marketing strategies and user acquisition.

Advisors and Partners

Joinn has assembled a team of experienced advisors and strategic partners to guide the company's growth and development. These individuals bring valuable insights and expertise from various industries, including finance, technology, and regulatory compliance.

8. Tokenomics

The $JOINN token will provide the following utility:

◆ Boosted APY’s

◆ Stake to earn $JOINN tokens

◆ Stake to receive premium products and services

◆ Platform discounts

◆ http://Joinn.io platform to invest a portion of the profits from the business to be used for token buyback and burn creating deflationary mechanics.

Token Details

· Token Name: Joinn Token

· Symbol: JOINN

· Total Supply: 420,000,000

$JOINN Distribution Schedule

Total Supply | % | Price | Raise Amount | FDV | TGE Release | Cliff | Months | |

Pre sale 1 | 16,800,000 | 4% | 0.015 | $252k | $6.3m | 10% | 3 | 9 |

Pre sale 2 | 16,800,000 | 4% | 0.03 | $504k | $12.6m | 20% | 2 | 6 |

Pre sale 3 | 21,000,000 | 5% | 0.06 | $1.26m | $25.2m | 30% | 1 | 3 |

Public Sale | 29,400,000 | 7% | 0.08 | $2.352m | $33.6m | 100% | 0 | 0 |

Early Backers | 84,000,000 | 20% | 12 | 36 | ||||

Advisors | 21,000,000 | 5% | 12 | 24 | ||||

Community | 84,000,000 | 20% | 0 | 0 | ||||

Team | 29,400,000 | 7% | 12 | 28 | ||||

Ecosystem Development | 117,600,000 | 28% | 0 | 36 | ||||

Total | 420,000,000 | 100% | $4.368m |

Token Distribution Plan

Allocation | Percentage of Total Supply |

|---|---|

Private Sale | 13% |

Public Sale | 7% |

Team and Advisors | 12% |

Ecosystem Development | 28% |

Community | 20% |

Early Backers | 20% |

Use of funds

Allocation | Percentage |

|---|---|

Development | 30% |

Marketing and User Acquisition | 25% |

Compliance and Legal | 30% |

Operational Expenses | 10% |

Reserve | 5% |

9. Roadmap

Phase 1 - 2024

· Polygon testnet MVP (Completed)

· The Root Network testnet development (Completed)

· Mastercard off ramp offering integration (Completed)

· Account Abstraction (Session tokens & glassless transactions) (Completed)

· KYC/AML integration (Completed)

· On-chain transaction history (Completed)

· Log in via non custodial wallets (Metamask + WalletConnect) (Completed)

· Joinn Real World Asset broker infrastructure and vaults (Completed)

· Real World Asset partner integration (Q3 2024) (Underway)

· The Root Network mainnet BETA launch and marketing campaign (Q3 2024) (Underway)

· Expansion of tokenized asset offerings and strategic partnerships (Q4 2024)

Phase 2 - 2025

· Build additional infrastructure to issue Real World Assets on any EVM compatible blockchain

· Chainlink CCIP (Deposit USDC on Ethereum straight into Joinn Accounts on Polygon)

· Mastercard tap payments (Apple, Samsung, Google)

· Web 2 login options (eg. Google, Facebook, Email)

· Launch B2B RWA Infrastructure offering

· Multichain expansion of B2C Platform

· Develop IOS and Android based applications

· Explore:

o Platform insurance options for end users

o Integrating with TradFi Bank accounts

o Fiat on/off ramp integration

Launch Plan

Joinn will execute a phased launch strategy, beginning with a private beta for early adopters in Q3 2024 and expanding to a public launch with a comprehensive marketing campaign in Q4 2024. Ongoing development will focus on enhancing platform features and expanding the range of available tokenized assets.

10. Case Studies and Use Cases

Real-World Examples

· Individual Investors: Alice, a retail investor, uses Joinn to purchase fractional shares of a gold token, diversifying her portfolio with minimal capital.

· Institutional Investors: A hedge fund leverages Joinn to gain exposure to tokenized corporate bonds, benefiting from increased liquidity and faster settlement times.

11. Conclusion

Summary

Joinn is poised to revolutionize the market for tokenized real-world assets, which is projected to grow from $300 billion to $10 trillion by 2030. Our platform stands out with its innovative 24/7 trading infrastructure, providing unparalleled liquidity and accessibility to both retail and institutional investors.

At the core of Joinn's offering is our user-centric design, which simplifies complex blockchain operations, making sophisticated investments accessible to all. Our multi-chain support ensures scalability, while rigorous security measures and proactive regulatory compliance build trust and longevity.

By democratizing access to tokenized real-world assets, Joinn is unlocking new possibilities for wealth creation and financial inclusion. Together, we can bridge the gap between traditional asset markets and the decentralized future. Join us in shaping the future of finance - visit our website to learn how you can be part of this transformative journey.

The future of finance is unfolding now, and Joinn invites you to be at its forefront:

For Investors: Gain early access to a high-growth market with significant upside potential. Our robust platform and innovative tokenomics model offer a unique investment opportunity in the rapidly expanding RWA space.

For Partners: Leverage our cutting-edge infrastructure to expand your offerings in the tokenized asset domain. Join our ecosystem and benefit from our liquidity solutions, multi-chain support, and user-friendly interface.

For Users: Experience the future of investing today. Gain unprecedented access to a world of investment opportunities previously reserved for institutional players. Start your journey into fractional ownership of high-value assets with minimal capital.

Join us in democratizing access to tokenized real-world assets and be part of the next big revolution in global finance. Together, we'll unlock new possibilities for wealth creation and financial inclusion.

Visit https://www.joinn.io/ to learn more about how you can participate in this transformative journey. The future of finance is tokenized, and it starts with Joinn.